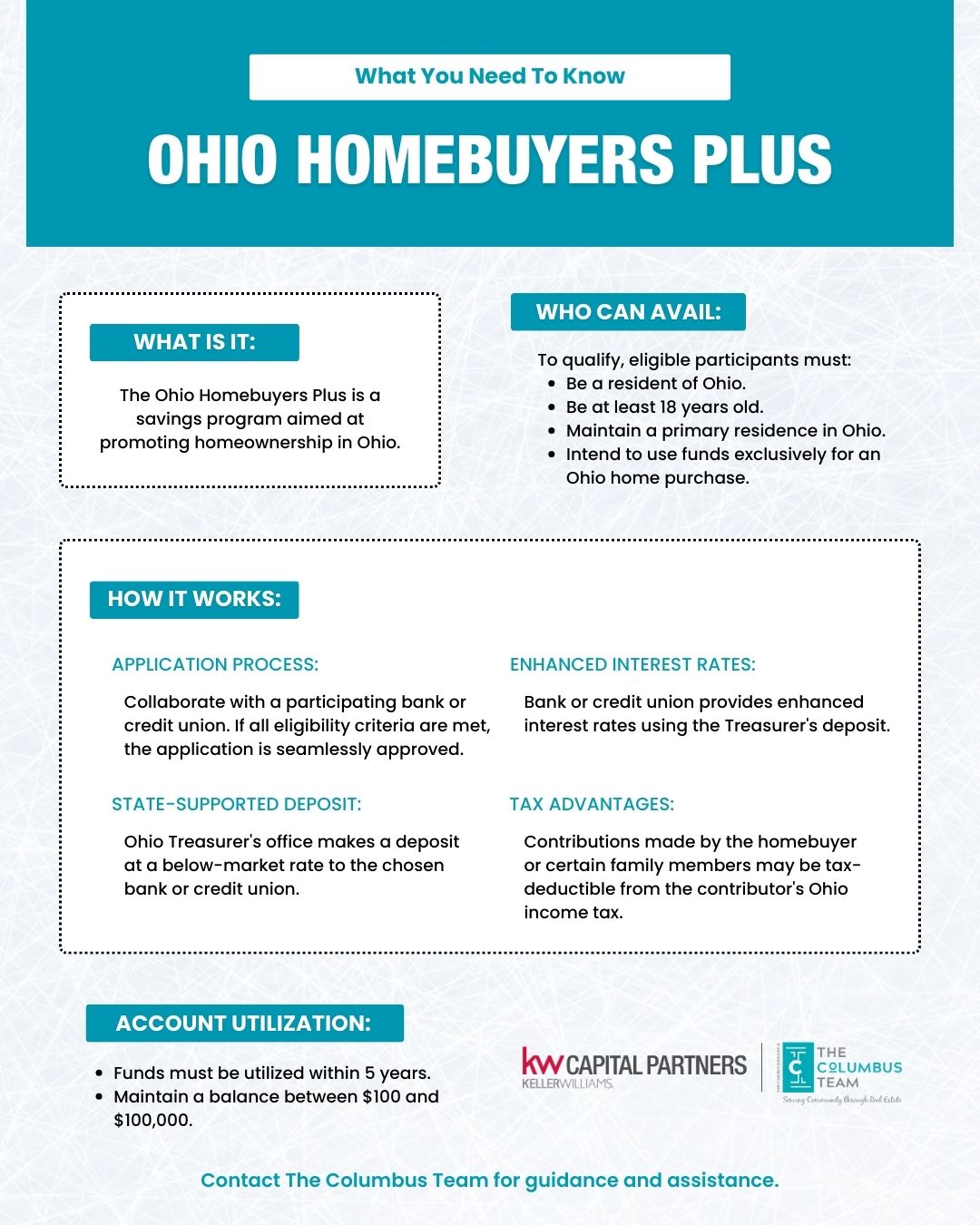

Ohio Homebuyers Plus Savings Program: A Gateway to Tax-Smart Homeownership

In the heart of Ohio, where investing in the dream of home is synonymous with investing in the state itself, Ohio Homebuyers Plus emerges as a beacon of opportunity. This specialized, tax-advantaged savings plan opens doors to enhanced interest rates and potential Ohio state income tax deductions for account holders.

Navigating Your Homebuying Journey with Ohio Homebuyers Plus:

To qualify for the benefits of an Ohio Homebuyer Plus account, eligible participants must:

- Be a resident of the State of Ohio.

- Be at least 18 years of age.

- Maintain a primary residence in the State of Ohio.

- Exclusively use account proceeds for the down payment or closing costs of a home purchase in Ohio.

Ohio Homebuyer Plus accounts, designed to fuel your homeownership aspirations, must be utilized within five years, maintaining a balance between $100 and $100,000. Ready to embark on this exciting journey?

Application Process:

- Prospective homebuyers collaborate with a participating bank or credit union to apply for a savings account through Ohio Homebuyer Plus.

- If all eligibility criteria are met, the application is seamlessly approved.

State-Supported Deposit:

- The Ohio Treasurer’s office extends support by making a deposit at a below-market rate with the chosen bank or credit union.

Enhanced Interest Rates:

- The bank or credit union utilizes the interest generated by the Ohio Treasurer’s deposit to provide an enhanced interest rate on the account holder’s savings account.

Tax Advantages:

- Contributions made by the homebuyer or certain family members may be tax-deductible from the contributor’s Ohio income tax.

Before embarking on this exciting homeownership journey, any applicant aiming to open an enhanced interest savings account through Ohio Homebuyer Plus is encouraged to review, understand, and adhere to the terms outlined in the program’s Participation Statement. This essential document ensures clarity on program guidelines and sets the stage for a seamless and rewarding experience.

Conclusion

Ohio Homebuyers Plus is not just a savings plan; it’s an investment in your future. Seize the opportunity, explore the possibilities, and let this program be your ally in turning the dream of owning a home in Ohio into a thriving reality.

Disclaimer: All applicants are advised to review the Ohio Homebuyer Plus Participation Statement meticulously before initiating the account-opening process. Your understanding of the program’s terms is crucial for a successful and rewarding experience. If you’d like some guidance, reach out and The Columbus Team will help.